Published on January 9, 2026

2026 Market Intelligence: Why Hong Kong is the Definitive Epicenter for Asian Capital In 2026

Hong Kong has long ago grown beyond its role as a regional gateway. It has been the main center for deploying Asian capital for a long time. While other places have struggled with the clash of traditional banking and digital innovation, Hong Kong has effectively set up its own unique approach. The city maintains its status as a top common law jurisdiction for creating a digital regulatory framework. This unique combination attracts liquidity from all over the world. For CEOs and leaders attending Consensus, Hong Kong is more than just a conference location it’s now represents the most efficient capital market in the Eastern Hemisphere.

The real strength of Hong Kong in 2026 lies in its connection with the Greater Bay Area . This is no longer a forward-looking idea but its a reality the city has created. The GBA has a combined GDP that rivals major European countries, with Hong Kong acting as the “Global Front Office” for this industrial powerhouse. This creates a synergy you cannot find in well-known economic centers like Singapore or Dubai. It pairs the sophisticated “Old Money” from mainland family offices with the advanced tech and manufacturing of Shenzhen. When deals are made during private dinners in Central, they often focus on tokenizing the vast physical infrastructure and supply chains that support the world’s manufacturing.

This is where Real-World Assets (RWAs) transform from a crypto narrative into the foundation of the global economy. It’s even more than just that, Hong Kong is now growing in numbers as a leading destination for the “New Wealth” usually consisting of the tech sharks growth in Southeast Asia. The city’s attractive tax incentives for family offices and its advanced Virtual Asset Service Provider licensing rules have lured a new group of investors. Family Offices expect transparency, quick transactions, and continuous liquidity and that’s what Hong Kong can provide for them.

By 2026, the Hong Kong Stock Exchange and the city’s private credit markets have become the main venues for these investors to reinvest their capital. The outcome is a concentrated pool of funding looking for high-quality, on-chain opportunities. One of the super power Hong Kong has is his strength and resilience. Despite changing geopolitical landscapes, Hong Kong remains the largest offshore Renminbi (RMB) hub in the world. This position helps the city secure a large amount of funding for currency internationalization. If you’re an institution that wants a seat at the table for the “Asian Century,” Hong Kong is really the only game in town. Name any other place where you can tap into massive amounts of RMB liquidity while still sleeping easy knowing you’re operating under a legal system that global investors actually trust?

The side events at Consensus serve as the starting point for those important discussions. Being present in these rooms means you’re not just networking; you’re positioning yourself at the key point where major capital flows meet. To see where the next five years of global growth is being funded, look at the balance sheets currently moving through Hong Kong.

Why RWAs Are the Center of Gravity This Year

Consensus Hong Kong arrives at a turning point. For years, the idea of putting real-world assets on-chain felt more like a promise than a reality. People talked about it on stages, wrote reports about it, and showcased small pilots, but most of it lived only in slides and conversations rather than in day-to-day markets.

That is changing fast.

Today, institutional allocators are not just observing from the sidelines they are starting to write checks and make decisions.

Banks that once issued public statements about “exploring blockchain” are now setting up systems, hiring teams, and looking for partners they can trust.

Funds that used to experiment with tiny test allocations are now raising capital with the sole purpose of putting real assets on-chain, including credit, treasuries, receivables, and supply chains.

And Hong Kong has become one of the key places where this shift is happening.It sits between global finance and fast-moving technology.Local regulators are open to new ideas, traditional institutions have balance sheets to deploy, and Web3 builders are already building products the market wants.

This makes Consensus week more than a typical conference.

While the main stage brings everyone together and sets the tone, the most practical conversations about capital, compliance, and execution are happening in smaller rooms the RWA side events where people speak openly about what they’re building and what they need.

If you care about tokenization whether you are building infrastructure, seeking partners, deploying capital, or trying to understand where the market is moving this is the week to pay attention and show up where decisions are being made.

How RWA Conversations Are Quietly Rewriting Market Structure

Real-world assets are not a just a buzzword they are long-standing financial instruments now that the market already understands, presented in a format technology can finally improve. The idea of tokenizing assets first appeared around the 2017-2018 period, but early attempts were held back by weak infrastructure, unclear rules, and limited institutional interest.

Over the past several years, that gap has steadily closed: stablecoins proved that real value could move on public rails, regulators began setting clearer guidelines, and institutions started running controlled pilots instead of just observing the space.

Today, tokenization covers everything from government bonds and private credit to real estate, infrastructure, revenue streams, and supply chains. Bringing these instruments on-chain means transactions settle in minutes instead of days, collateral becomes visible rather than buried in spreadsheets, compliance rules can be built directly into code, and markets operate continuously instead of around a bell.

Most importantly, access widens beyond a small circle of institutional players to a global pool of participants. In that sense, RWAs are less about “crypto” as most people imagine it and more about updating the financial plumbing so value can move with the speed and transparency of information. That evolution from early experiments to active deployment is why banks, asset managers, and allocators are now engaging seriously, and why RWA-focused events are drawing the most committed decision-makers at gatherings like Consensus Hong Kong.

A Smarter Approach to Structuring Your Consensus Schedule

Consensus is big, crowded, and easy to get swallowed by. The main program offers plenty of panels and stages, but the real progress tends to happen outside the spotlight, in smaller rooms where people can speak plainly and get to the point faster.Many attendees fall into the same pattern every year they accept every invitation, cross the city from morning to night, and hope that luck places the right person beside them.

The people who leave Hong Kong with real momentum take a very different approach. They are selective about where they spend their time and make deliberate choices about which rooms are worth entering. They focus on events built around the topics that matter to them, not whatever happens to show up in their inbox. They spend time with people who can help them move their ideas forward instead of spreading themselves thin across random encounters. They stay anchored in one district whenever possible to avoid losing hours in taxis and train stations. And they treat every conversation not as a one-off exchange but as the start of a longer relationship. In the end, the value of Consensus has little to do with how many wristbands or badges you collect and everything to do with who you met, what you learned, and which conversations continue after the week is over.

How to Choose an Event Wisely

Choosing which side events to attend is just as important as attending the conference itself, and it starts with asking the right questions before you RSVP. The first thing to understand is who will actually be in the room. If the event isn’t attracting allocators, asset managers, infrastructure builders, or people involved in real deployments, then it is more likely positioned for marketing than meaningful work. It also helps to look at how the guest list is shaped. Open doors bring crowds, but curated or invite-only events often bring the decision-makers you want to meet. The topic matters as well.

General crypto mixers and social gatherings can be enjoyable, but if your focus is RWAs, you will gain more value in rooms where the conversation is centered on structuring, compliance, or capital flows. The physical environment is another factor. A loud venue filled with hundreds of people leaves little room for thoughtful discussion, while smaller settings can support deeper, more productive exchanges.

Logistics matter more than most attendees expect. A promising event on the opposite side of the city during peak traffic can easily cost you several hours you never get back. And one final rule applies across the board: make contact before you arrive. A quick message to a speaker, host, or attendee often reveals more about whether a room is worth your time than any event description online, and it may even open doors that are not publicly advertised.

The Must-Know RWA Side Events of Consensus Hong Kong 2026

Before the main conference begins, the most important institutional conversations of the week will already be happening at Tokenized Capital Summit 2026 Hong Kong.

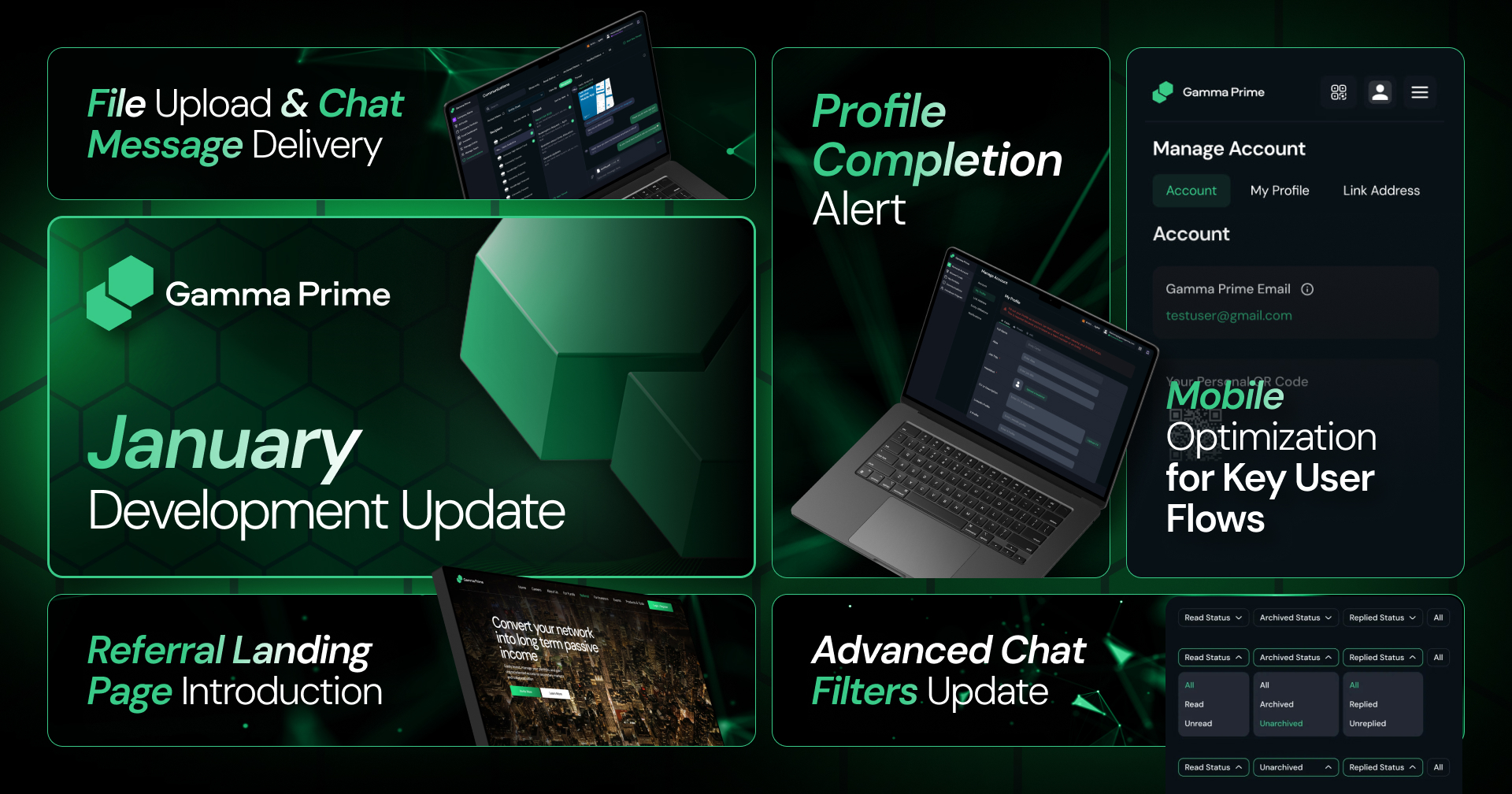

Hosted by Gamma Prime, the summit is a focused meeting point for traditional capital and blockchain-based tokenization. We bring the same institutional standard to Hong Kong that shaped our previous flagship events.

Tokenized Capital Summit 2025 in Abu Dhabi: Tokenized Capital Summit 2025 Abu Dhabi

The summit hosted 2,500+ senior decision-makers, including representatives from family offices, investment firms, hedge funds, and venture capital funds. The program featured keynote speeches and panels with leaders such as Charles Hoskinson, Yat Siu, Reeve Collins, and Brian Pellegrino, alongside executives from 21Shares, Galaxy Ventures, Spartan Capital, Crypto.com, Revolut, and HashKey.

Discussions centered on the institutional adoption of compliant on-chain markets and the evolving infrastructure required to scale tokenized capital globally.

Tokenized Capital Summit 2025 in Singapore Tokenized Capital Summit 2025 Singapore

An approved-only gathering of 4,500+ participants, hosted by Gamma Prime, featured a high-caliber speaker lineup including Arthur Hayes, Anthony Scaramucci, Sandeep Nailwal, Yat Siu, and senior leaders from Invesco, 21Shares, Galaxy Ventures, VanEck, Coinbase, Franklin Templeton Digital Assets, Polygon, The Sandbox, HashKey, Binance, and others.

The agenda was sharply focused on bridging traditional capital allocators with decentralized finance, exploring how tokenized assets, regulation, and institutional adoption are reshaping global capital flows. With a strong concentration of C-level executives and institutional investors, the summit positioned itself as a Day 0 forum for builders and investors seeking direct access to capital and decision-makers, rather than crowded, high-level panels.

Heading to the Tokenized Capital Summit in Hong Kong? Connect with the community in our Telegram chat: https://t.me/TokenizedCapitalSummit

February 9

Tokenized Capital Summit The highest-signal RWA kickoff of the week.

Allocators, funds, tokenization platforms, and institutions before the crowd arrives.

Liquidity 2026 Focusing on market structure, issuance, settlement, and the future of tokenized markets.

February 10

RWA Tokenization Summit Deep-dive into the machinery of bringing real assets on-chain: compliance, custody, liquidity, credit structuring.

VC & LP Deal Hour (Invite-Only) A room where introductions stick and capital conversations begin.

Consensus x SALT Summit The marquee institutional event of the week, designed specifically for high-level capital allocators and asset managers.

February 11

DePIN + RWA Infrastructure Day

Technical sessions for those building rails rather than headlines.

Founder / Allocator Private Dinners

Quiet rooms where partnerships form faster than on stage.

February 12

LP Roundtables Closed-door progress conversations for funds deploying into tokenization.

Post-Consensus

RWA Summit (Feb 12-13): Organized by WOW SUMMIT & UVECON, this is the primary “continuation” event where the regulatory and operational work happens after the main conference noise dies down.Where regulatory, legal and operational details finally get worked through.

Consensus Hong Kong 2026

While the digital asset market has gone through a major adjustment in the last 24 months, the upcoming Consensus Hong Kong 2026 in February brings a sense of cautious optimism. The road to institutional integration has been uneven, but the growing interest in Real-World Asset (RWA) tokenization indicates a significant change is happening. In the past, discussions focused mostly on retail-driven volatility, now, the conversation increasingly revolves around strict licensing rules and the involvement of traditional credit markets in public systems.

However, the real value of the week lies not in the main presentations but in the private side events where the basics of this new economy are being explored. Similar to how the Fed closely watches core inflation measures, institutional investors are examining the technical and legal aspects of RWA platforms seeking the stability and compliance needed to invest substantial capital. The upcoming summit offers a hopeful outlook for those wanting to shift from speculation to building lasting, on-chain financial systems.is not just another conference cycle.

It is the first major gathering where real-world assets not narratives take center stage.

If you allocate your time wisely, you’ll find yourself in rooms where capital commitments begin, partnerships take shape, and technology and finance finally meet on equal terms.RWAs are no longer a future trend.They are where institutional energy is flowing right now.

Choose your events deliberately.Stay close to the people who are building.And treat this week as the inflection point it can be.Because the next phase of global finance won’t be decided in the main hall it will be shaped in the side rooms you choose to walk into.