Published on January 3, 2026

During December we focused on improving clarity, access, and usability across key investor and referral flows. The work this month was about simplifying how users discover funds, interact with referrals, and manage team access, while laying groundwork for more personalized experiences in 2026.

Tokenized Capital Summit 2026 Hong Kong

Tokenized Capital Summit 2026 Hong Kong, taking place on February 9, 2026 at Cordis Hong Kong. The event is designed as a focused gathering for private capital allocators, fund managers, and ecosystem builders exploring tokenization across private markets, including hedge funds, private credit, and real-world assets.

The summit is expected to host 3,000+ attendees, with approximately 70% representing C-level executives, HNWIs, family offices, fund managers, and senior decision-makers, creating a high-signal environment for strategic discussions and meaningful connections around the future of tokenized private capital.

Check out Gamma Prime list of Best side events in Hong Kong 👉 https://blog.gammaprime.com/best-side-events-at-consensus-hong-kong-2026-february-edition-2

Introducing Investors Landing

We launched a new Investors Landing page to better explain Gamma Prime’s private capital offering. The page clearly outlines how investors access curated funds, exclusive deal flow, and tailored portfolio opportunities through a structured onboarding process.

The flow introduces membership application, personal profiling, and selective admission, helping set expectations and ensure alignment with investors seeking institutional-grade private market access.

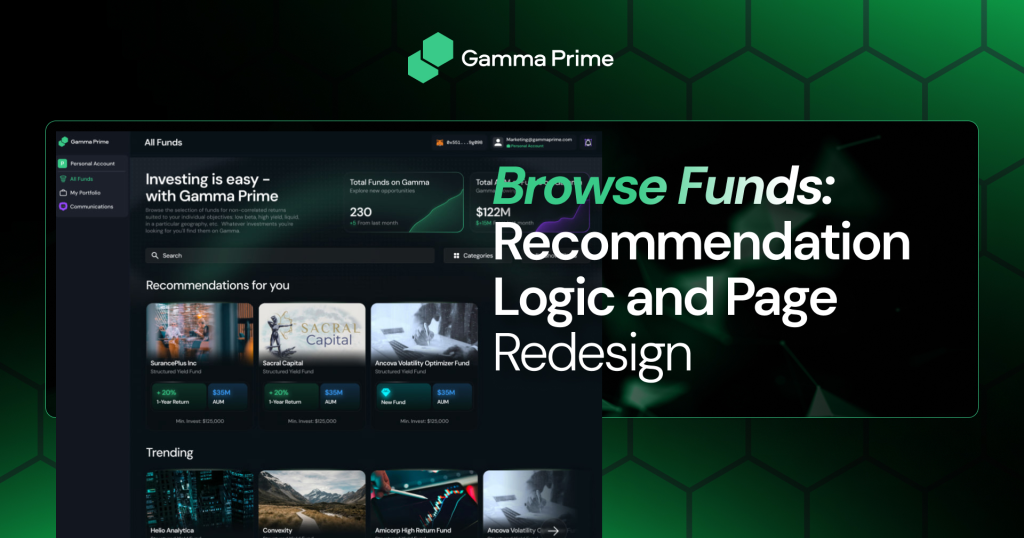

Browse Funds: Recommendation Logic and Page Redesign

We improved the Browse Funds experience to make fund discovery clearer and more intuitive. The page now highlights relevant funds through smarter recommendations, helping users find suitable opportunities more efficiently.

Funds are displayed by primary category only, and categories that are not available to a user are automatically hidden. This removes empty sections and ensures a clean, focused experience that reflects each user’s eligibility and access.

Fund Referral Link

We added support for fund-specific referral links. Users can now share direct links to individual fund pages through the referral program, rather than sending generic platform links.

This change makes referrals more targeted and improves the quality of traffic by directing invitees to specific investment opportunities.

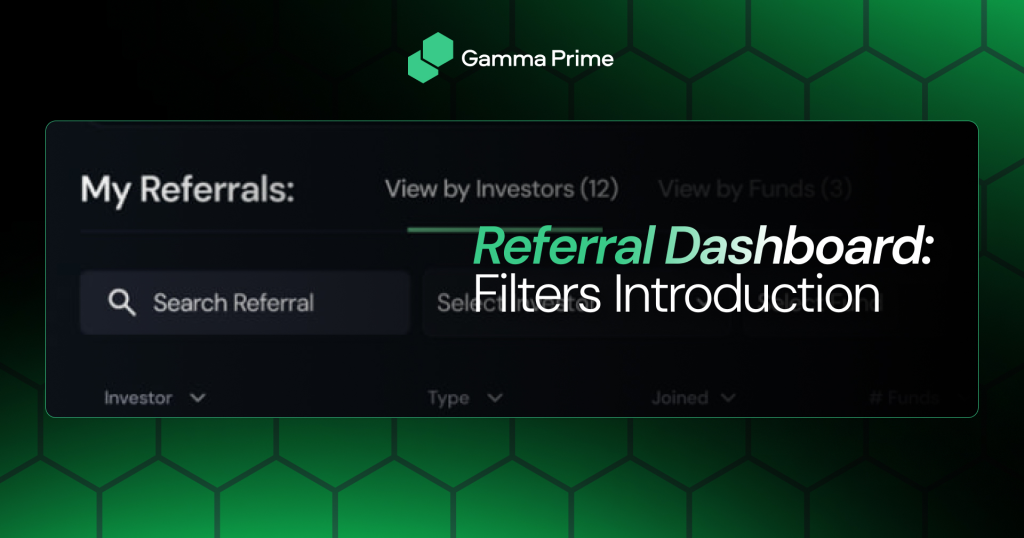

Referral Dashboard: Filters Introduction

Filtering functionality was added to the Referral Dashboard to improve usability and reporting. Users can now filter referral data to better understand performance and engagement without manual review.

This update makes the dashboard easier to navigate for users with higher referral activity and supports faster decision-making.

Referral Program Access Simplification

Access to the Referral Program was simplified by removing the requirement to complete “Your Profile.” Users can now participate in referrals earlier, reducing friction and enabling engagement without additional setup steps.

Manage Team: Delete Member Modal Update

The Delete Member modal on the Manage Team page was updated to provide clearer context and confirmation. The changes help teams better understand the impact of removing a member before completing the action.

This improves safety and clarity when managing team access.

Closing Note

December concluded a year of steady progress and platform maturation. The updates delivered this month improve discovery, referral flows, and team management, while establishing a stronger foundation for personalization and growth in 2026. Our focus remains on building a reliable, institutional-grade marketplace for curated private investments, giving investors access to hard-to-find, uncorrelated opportunities across hedge funds, private credit, and alternative strategies spanning both digital and real-world asset classes.